|

|

||

|

|

||

|

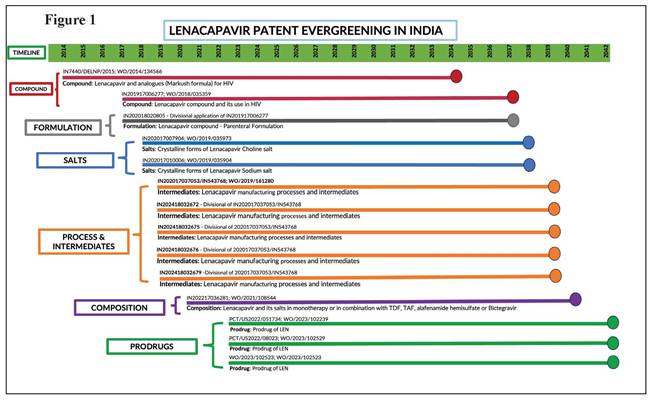

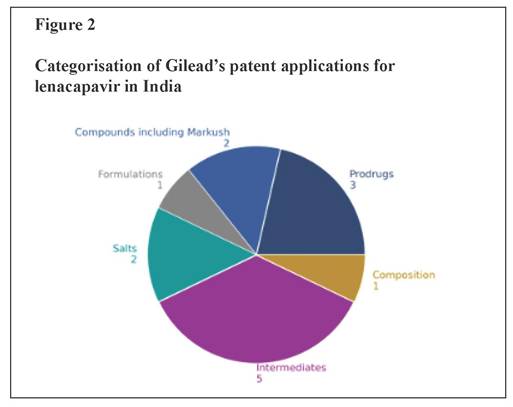

Protecting profits, endangering lives The new drug lenacapavir marks a breakthrough in the fight against HIV/AIDS but manufacturer Gilead’s aggressive use of the patent system to prolong its monopoly on production is impeding access. LENACAPAVIR (LEN), a groundbreaking medication for both HIV treatment and pre-exposure prophylaxis (PrEP), marks a significant advancement in the fight against HIV. Its long-acting formulation – requiring just two doses per year – improves adherence, reduces the burden of frequent dosing, and offers a more convenient, effective option for both prevention and long-term management. However, priced exorbitantly by Gilead at $42,250 per patient per year, LEN remains out of reach of most patients. A 2024 expert study led by Andrew Hill of Liverpool University estimates that a generic version of LEN could be produced for as little as $40 while still maintaining a 30% profit margin, exposing the stark contrast between production costs and market price.¹ Ensuring widespread, affordable access to long-acting treatments like LEN is critical to preventing new infections and advancing the global fight against HIV/AIDS. According to the Joint United Nations Programme on HIV/AIDS (UNAIDS), with the LEN breakthrough, the world has a shot at ending AIDS.² Yet, Gilead is aggressively working to extend its monopoly on LEN through patent ‘evergreening’ strategies, delaying competition and keeping prices high. PrEP access and affordability barriers Globally, 40 million people are living with HIV, yet only about 30 million have access to life-saving treatment. According to UNAIDS, more than 3,500 people acquire HIV every day, and over the past five years, reductions in new infections have been marginal.³ More than 60% of new infections occur within marginalised communities, yet access to PrEP remains severely limited. In 2023, only 3.5 million people used oral PrEP to prevent HIV transmission – far below the 10 million target for 2025, which is crucial for meaningfully curbing new infections. New long-acting treatments have the potential to revolutionise HIV prevention, allowing people at high risk to protect themselves with just a few injections per year. LEN is currently approved for the treatment of multi-drug-resistant HIV infection in adults.⁴ In 2025, the United States Food and Drug Administration accepted a new drug application for LEN as a twice-yearly injectable HIV-1 capsid inhibitor for use in HIV prevention as PrEP.⁵ The PURPOSE 1 trial for PrEP, conducted among cisgender women in sub-Saharan Africa, demonstrated 100% efficacy, with no HIV infections reported.⁶ In PURPOSE 2, a multicentre trial in high-risk populations, LEN reduced HIV infections by 96% compared with background HIV incidence (bHIV), with only two incident cases among 2,179 participants.⁷ Further, the CAPELLA and CALIBRATE trials showed that LEN helps to control HIV in both treatment-experienced individuals with multi-drug-resistant HIV and treatment-naïve individuals living with HIV.⁸ These results underscore lenacapavir’s potential as a game-changing, long-acting PrEP option. However, Gilead’s patent power play – specifically its evergreening strategies to extend market monopoly – allows it to impose excessively high prices and hinder competition from generics, delaying widespread, affordable access and putting millions at risk. Patent evergreening: Extending Gilead’s monopoly over lenacapavir Gilead is employing patent evergreening tactics to extend its monopoly on lenacapavir. This common strategy among pharmaceutical companies involves staggering patent filings and securing additional patents on modifications, different forms or new uses of an existing compound to prolong exclusive rights beyond the expiration of the primary patent (Figure 1). By leveraging these secondary patents, Gilead can delay generic competition and continue to keep prices artificially high, consequently restricting affordable access. Between 2014 and 2022, Gilead filed 14 patent applications for LEN in India. The latest of these applications, if granted, is set to expire in 2042 – nearly 28 years after the first application was filed. Notably, patent filings continue unabated, with the submission of an additional patent application recently (IN20211700214) though its specifics are yet to be disclosed. Granting these patents would legitimise Gilead’s evergreening strategy of extending its patent monopoly beyond the standard 20-year period, which, in this case, will end in 2034, when the first patent expires. Gilead’s aggressive patent strategy employs a multi-faceted approach designed to strengthen its exclusive rights over LEN and erect entry barriers to Indian manufacturers capable of producing affordable generic alternatives. Figure 2 categorises Gilead’s 14 patent applications based on the types of claims. The first application (IN7440/DELNP/2015) contains patent claims with a Markush structure, a type of broad patent claim commonly used by pharmaceutical companies to seek patent protection over a large number (often millions) of compounds, rather than a specific chemical structure, in a single patent. In this first application that features a Markush structure, the LEN compound was not specifically disclosed, although complete disclosure is a prerequisite for anyone seeking patent protection. The second application (IN201917006277) specifically claims the LEN compound as well as formulations and intermediates for the preparation of lenacapavir. Additionally, it also claims a few compounds that are not related to LEN and are structurally distinct from lenacapavir. A subsequent patent application (IN202018020805) includes a parenteral formulation (a pharmaceutical preparation which is designed for administration via means like injection and infusion). This application is a divisional application stemming from the original compound application (IN201917006277). Further applications have been filed on different forms of salts (choline and sodium) and polymorphs of LEN (IN202017007904 and IN202017010006). By patenting different salts and polymorphs, Gilead is strategising to extend its patent monopoly over LEN until 2039. Gilead has also filed at least five patent applications covering the manufacturing process and intermediates of lenacapavir, with the last four of such applications being divisional of a single granted patent (IN202017037053/IN543768). Additionally, Gilead has also filed an application (IN2022170362 81; WO/2021/108544) which was originally filed as a method-of-treatment patent application in Europe and the US. However, the claims were entirely amended to composition claims, presumably to circumvent Section 3(d) and (i) of India’s Patents Act 1970 which disallows patents being granted on treatment methods. Gilead has also submitted multiple prodrug patent applications in India (WO2023102239; WO2023102529; WO2023102523), reinforcing its broader strategy to extend patent protection and maintain market exclusivity for lenacapavir. Figure 2 clearly illustrates how Gilead is strategically manipulating the patent system to secure extended market monopoly over LEN – enabling it to control the production and supply of lenacapavir, dictate market prices and maximise profits. In an apparent effort to deflect criticism of its evergreening and monopolistic tactics, Gilead announced on 2 October 2024 that it would grant voluntary licences (VLs) to six manufacturers from developing countries to produce and supply generic versions of LEN to 120 low- and middle-income countries. While the company claims this move is aimed at expanding access, the details of the licence tell a different story. The licence explicitly excludes many upper-middle-income countries (UMICs) as classified by the World Bank – despite these countries accounting for 41% of new HIV infections and 37% of the global population living with HIV.⁹ Notably, supply to these excluded countries is prohibited even in cases of compassionate use, the absence of patents, or where compulsory licences have been issued. The VL also includes several restrictive and anti-competitive clauses, including stringent anti- diversion provisions and limitations on sourcing active pharmaceutical ingredients. These terms strongly suggest that Gilead’s VL is less about public health and more a calculated move to suppress criticism, maintain market control and protect its LEN monopoly – especially as its patent claims face growing legal challenges worldwide. Global oppositions to Gilead’s patent applications Gilead’s patent claims are being actively challenged in several countries, such as detailed in Figure 3. Recently Argentina’s National Institute of Industrial Property (INPI) rejected Gilead’s patent application for the LEN compound (Application No. ARP170102299) on the grounds that the compound had already been disclosed in the Markush patent claims and therefore violates Argentina’s patent law, making it unpatentable.¹⁰ Prior to the rejection, INPI had raised its objections to the grant of the patent with Gilead but did not receive an adequate response within the stated timeframe. In its pre-final rejection order, INPI cited prior art including the earlier Markush disclosure encompassing LEN. The examiner emphasised that the disclosure of a class of compounds through a Markush structure constitutes prior art as it inherently includes all compounds that fall within the scope of that structure. Thus, even if a compound is not explicitly named, it is considered to be disclosed if it fits within the parameters of the Markush structure. Gilead did not respond to the objection within the prescribed timeframe, resulting in the rejection of the application. Challenging LEN patent applications in India As shown in Figure 3, pre-grant oppositions have been filed in India against key patent applications. These applications include the very first patent application filed by Gilead, claiming LEN through a Markush structure. Further, pre-grant oppositions have been filed against the patent applications claiming the LEN compound as well as two patent applications claiming different salt forms of LEN. The major grounds for the pre-grant oppositions are as follows: Novelty: The first patent application claims the LEN compound through a Markush structure, as shown in Figure 1. Regardless of the broader debates around the patentability of a Markush structure, it is a well-established fact that this initial application discloses the LEN compound, thereby compromising the novelty claims of subsequent applications on LEN. Gilead has cited a technical ground to bypass the novelty objections, claiming that the patent applications covering salt forms of LEN were filed prior to the publication of the LEN compound patent application. Inventive step: Though LEN is the first capsid inhibitor approved by the regulatory agencies, it is not the first capsid inhibitor molecule. Capsid inhibitors have been known to the scientific community since 2003, and numerous efforts have since been made to bring compounds in this class to market. The core of LEN is based on a capsid molecule developed in 2010 by Pfizer known as PF-3450074. The pre-grant oppositions argue that changes made by Gilead are obvious to a person skilled in the art and therefore lack inventive steps. At the time of these applications, capsid technology was known and scientists commonly used docking techniques, a method where computer simulations predict how well a molecule binds to a target (like the HIV capsid). This made it easier to identify potential inhibitors, reducing the element of invention. Insufficient disclosure: The first application containing the Markush structure covers many possible chemical structures and the applicant is expected to provide detailed steps to show the enablement of each of the structures, i.e., how these structures actually work. However, the application does not disclose clear steps to make the claimed compounds, nor does it include specific synthetic routes, experimental data or biological activity details for all claimed compounds or proof that all the claimed compounds work. This makes it unclear whether all the compounds covered in the patent can actually be made and used as intended. Without this information, the claims are too broad and uncertain, failing to meet the requirement that a patent must fully explain how the invention is carried out. Similarly, the descriptions in other patent applications for the compound also do not provide enough information for someone with basic knowledge in organic chemistry to make the claimed compounds, such as lenacapavir compound or its salts and crystals. Section 3(d): One of the important safeguards against patent evergreening is Section 3(d) of the Indian Patents Act. This section contains a list of elements that are excluded from patent protection. It states: ‘the mere discovery of a new form of a known substance which does not result in the enhancement of the known efficacy of that substance or the mere discovery of any new property or new use for a known substance or of the mere use of a known process, machine or apparatus unless such known process results in a new product or employs at least one new reactant. Explanation.—For the purposes of this clause, salts, esters, ethers, polymorphs, metabolites, pure form, particle size, isomers, mixtures of isomers, complexes, combinations and other derivatives of known substance shall be considered to be the same substance, unless they differ significantly in properties with regard to efficacy’. According to Section 3(d), any new form of a known substance is patentable only if the new form results in enhanced efficacy. None of the subsequent applications, including the applications on salts, have shown any evidence of enhanced efficacy compared with the base compound. In addition, it is also important to note that the voluntary licence issued by Gilead explicitly lists multiple patent applications (as detailed in Appendix 2 of the VL), and states that they all pertain to a single product – lenacapavir. This clearly indicates that the subsequent applications do not meet the requirements of Section 3(d), as they fail to demonstrate significant enhancement in efficacy over the original disclosure. Conclusion Gilead’s evergreening strategy for LEN reflects a broader pattern of delaying access to improved treatment options while prioritising profit maximisation at the expense of timely affordable care for patients. The large number of patent applications filed in India is a deliberate tactic to restrict the freedom to operate for generic manufacturers. This layering of patents is about creating a thicket of legal obstacles, significantly raising the costs and risks for generic producers and delaying the availability of more affordable alternatives. The resulting uncertainty around patent validity discourages generic companies from investing in the development of cost-effective alternatives, thereby weakening competition and ultimately limiting access to life-saving treatment. Addressing these monopolistic practices requires a combination of legal challenges, patent oppositions and policy reforms. The situation of LEN underscores the enduring relevance of the Indian Supreme Court’s landmark ruling in the Novartis case.11 In that decision, the Supreme Court stated: ‘We certainly do not wish the law of patent in this country to develop on lines where there may be a vast gap between the coverage and the disclosure under the patent; where the scope of the patent is determined not on the intrinsic worth of the invention but by the artful drafting of its claims by skillful lawyers, and where patents are traded as a commodity not for production and marketing of the patented products but to search for someone who may be sued for infringement of the patent.’ The granting of excessive patents on LEN risks stifling fair competition and delaying the entry of affordable alternatives – highlighting the urgent need for stronger scrutiny when granting patents and for pro-competition policies to safeguard global access to life-saving medicines. – TWN The above was first published as a Third World Network Briefing Paper (May 2025). Notes

*Third World Resurgence No. 363, 2025/2, pp 27-31 |

||

|

|

||